In the realm of international trade and commerce, understanding the intricacies of pricing is essential for both buyers and sellers. Among the various pricing terms used in international transactions, the term FOB Price stands out as a commonly employed and widely recognized concept. This pricing term has a specific definition and implications that are crucial to grasp for anyone involved in global trade.

Unveiling the FOB Price Definition

FOB, an acronym for Free On Board, is a pricing and shipping term used extensively in international trade. It signifies that the seller has fulfilled their obligations once the goods have been loaded onto the buyer’s chosen vessel at the designated port of shipment.

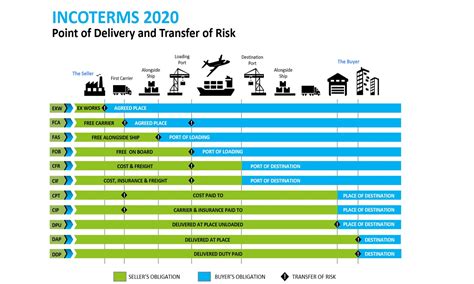

The FOB price definition is deeply rooted in the Incoterms, a set of international commercial terms developed by the International Chamber of Commerce (ICC) to provide clarity and uniformity in global trade transactions. Incoterms, which are regularly updated, offer a standardized framework for defining the responsibilities and risks of sellers and buyers in international trade.

Within this context, the FOB price serves as a critical component, influencing the financial aspects of the trade agreement and shaping the logistics of the shipping process.

Key Components of FOB Price

The FOB price is a comprehensive term that encapsulates several critical aspects of an international trade transaction. These include:

- Pricing: The FOB price represents the cost of the goods at the point of departure from the seller's premises, excluding any additional charges that may arise during transportation.

- Risk Transfer: Once the goods are loaded onto the buyer's designated vessel, the risk of loss or damage shifts from the seller to the buyer. This transfer of risk is a fundamental aspect of the FOB pricing term.

- Ownership Transfer: While the risk transfer occurs upon loading, the ownership of the goods may or may not transfer at the same time, depending on the specific agreement between the buyer and seller.

- Logistics: The FOB price implies that the seller is responsible for arranging and paying for the transportation of goods to the designated port of shipment. From there, the buyer assumes responsibility for further transportation and any associated costs.

It is crucial to understand that the FOB price does not include any costs related to shipping, insurance, or any additional expenses incurred during the transportation process. These costs are typically borne by the buyer and are often negotiated separately.

Benefits and Considerations of FOB Pricing

The FOB pricing term offers several advantages for both buyers and sellers in international trade.

For Sellers:

- Reduced Risk: Sellers can transfer the risk of loss or damage to the buyer once the goods are loaded onto the vessel, reducing their liability.

- Clear Pricing: FOB pricing provides a transparent and standardized pricing structure, making it easier for sellers to quote and negotiate prices with buyers.

- Logistics Control: Sellers have control over the initial logistics, ensuring efficient loading and transportation to the port of shipment.

For Buyers:

- Flexibility: Buyers have the flexibility to choose their preferred shipping method and carrier, allowing for customized transportation solutions.

- Cost Control: By excluding shipping costs from the FOB price, buyers can negotiate and manage their transportation expenses independently.

- Risk Management: Buyers assume the risk of loss or damage once the goods are loaded, providing an opportunity for proactive risk management strategies.

However, it is essential to consider the potential challenges associated with FOB pricing. These may include increased administrative burdens, especially for smaller businesses, and the need for careful risk assessment and management to avoid unforeseen losses.

Real-World Application: A Case Study

Let’s illustrate the FOB price concept with a practical example. Imagine a manufacturer, GlobalWidgets, based in China, who has received an order for a batch of electronic components from a buyer, TechCorp, located in the United States.

The two parties agree on an FOB pricing term, where GlobalWidgets quotes an FOB price of $10,000 for the components. This price covers the cost of the goods at the seller's premises, excluding shipping and insurance costs.

Once the goods are loaded onto TechCorp's chosen vessel at the designated port in China, the risk of loss or damage transfers to TechCorp. At this point, TechCorp becomes responsible for arranging and paying for the transportation of the goods from the port of shipment to their final destination in the United States.

| Component | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Resistors | 1000 units | $2.50 | $2,500 |

| Capacitors | 500 units | $5.00 | $2,500 |

| Integrated Circuits | 200 units | $15.00 | $3,000 |

| Total | $10,000 |

In this scenario, TechCorp can choose their preferred shipping method, whether it be air freight, sea freight, or other modes of transportation, and negotiate the shipping costs separately. This flexibility allows TechCorp to optimize their logistics based on factors such as speed, cost, and reliability.

Future Implications and Trends

As international trade continues to evolve, the FOB pricing term remains a relevant and widely used practice. However, the increasing complexity of global supply chains and the emergence of new technologies are shaping the future of trade pricing.

One notable trend is the integration of digital technologies into the shipping process. Electronic data interchange (EDI) and blockchain-based solutions are enhancing the transparency and efficiency of FOB pricing, reducing administrative burdens, and improving risk management capabilities.

Additionally, the growing emphasis on sustainability and environmental concerns is influencing pricing strategies. As businesses strive to reduce their carbon footprint, FOB pricing may need to adapt to incorporate green shipping practices and consider the environmental impact of transportation choices.

What are the key differences between FOB and other pricing terms like CIF or EXW?

+FOB differs from CIF (Cost Insurance and Freight) in that FOB does not include insurance or freight costs, which are borne by the buyer. EXW (Ex Works) places even more responsibility on the buyer, as the seller only delivers the goods at their premises, and the buyer arranges and pays for all transportation and associated costs.

How does FOB pricing impact the shipping process and logistics management?

+FOB pricing gives buyers control over the shipping process, allowing them to choose the shipping method and carrier. This flexibility can lead to cost savings and optimized logistics. However, it also requires buyers to manage the risks and responsibilities associated with transportation.

Are there any potential drawbacks or challenges associated with FOB pricing for small businesses?

+Yes, FOB pricing can present challenges for small businesses, especially in terms of administrative burdens and risk management. The need to manage shipping logistics and negotiate costs separately can be time-consuming and require specialized knowledge. Additionally, small businesses may face higher risks due to their limited resources for risk mitigation.